Revealed: the dark secret at the heart of Rachel Reeves’s Budget

05 November 2024 6:00am GMT

The dark secret at the heart of Rachel Reeves’ Budget is buried at the bottom of page 41 of the 205-page Office for Budget Responsibility’s (OBR) assessment.

Labour’s policies, the fiscal watchdog deduces, are “shifting real resources out of private households’ incomes in order to devote more resources to public service provision”.

Tax and spend is back in a big way.

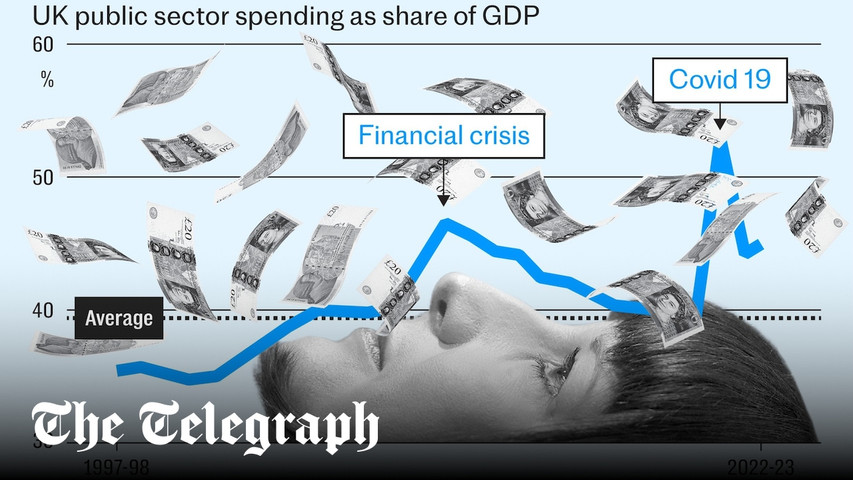

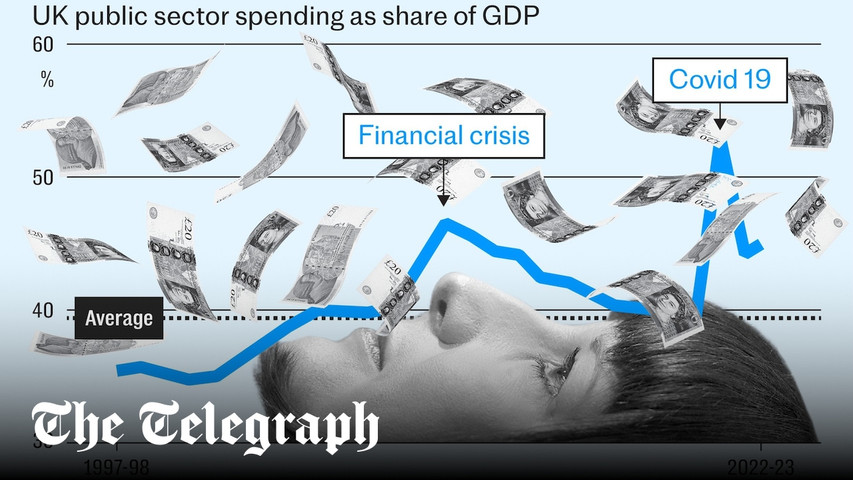

HM Revenue and Customs (HMRC) receipts are set to rise by some £40bn, the steepest hike since 1993, and over £70bn in additional expenditure will swell the size of the state to over 44pc of GDP – its most bloated since the early 2010s.

Forecasts show ordinary Britons are net losers in this equation, with real household disposable income £276 lower in five years’ time as a result of the Budget.

The Chancellor’s changes to employers’ National Insurance (NI) contributions – particularly the bump in the main rate from 13.8pc to 15pc – will make bosses’ tax bills £26,000 dearer on average. The majority of this will be passed on to employees in the long-term.

She has since admitted private sector workers will see a reduction in pay, with negative inflation-adjusted wage growth on the cards in 2026 and 2027.

Public sector workers, on the other hand, have been handed bumper rises all summer: junior doctors, 22pc; train drivers, 15pc; Armed Forces personnel, 6pc. The list goes on.

All of this has a measurable effect on the Government’s wage burden. The OBR forecasts the bill to go up by an average of 4.6pc between this year and 2029/30 – increasing by 30.7pc in total from £172bn to £225bn.

This is also because of a boom in the number of people on the state payroll. From 5.6 million in the first quarter of 2023, it will grow to 6.2 million by the same period in 2029 – up 10.6pc. The March forecast under the Conservatives came in 420,000 lower by that time.

Piecing together Budget and manifesto commitments, this surplus is likely to include 13,000 neighbourhood police officers, 8,500 additional mental health staff in the NHS, 6,500 teachers, 5,000 HMRC compliance officers and 3,000 extra workers tackling benefits fraud.

The implications on pensions are massive. By 2029, expenditure on public service pensions is set to be £2.4bn higher than under the Tories’ plans.

But the gap is only set to widen down the line. Annual growth was projected to average 3pc between 2023-24 and 2028-29 under former chancellor Jeremy Hunt – a figure that has now crept up to 3.6pc.

Given that government departments, however, also owe National Insurance contributions on their employees’ salaries, the net effect appears to be cancelled out.

But the cost remains, coming instead in the form of compensation paid out to the public sector through higher day-to-day

05 November 2024 6:00am GMT

The dark secret at the heart of Rachel Reeves’ Budget is buried at the bottom of page 41 of the 205-page Office for Budget Responsibility’s (OBR) assessment.

Labour’s policies, the fiscal watchdog deduces, are “shifting real resources out of private households’ incomes in order to devote more resources to public service provision”.

Tax and spend is back in a big way.

HM Revenue and Customs (HMRC) receipts are set to rise by some £40bn, the steepest hike since 1993, and over £70bn in additional expenditure will swell the size of the state to over 44pc of GDP – its most bloated since the early 2010s.

Forecasts show ordinary Britons are net losers in this equation, with real household disposable income £276 lower in five years’ time as a result of the Budget.

The Chancellor’s changes to employers’ National Insurance (NI) contributions – particularly the bump in the main rate from 13.8pc to 15pc – will make bosses’ tax bills £26,000 dearer on average. The majority of this will be passed on to employees in the long-term.

She has since admitted private sector workers will see a reduction in pay, with negative inflation-adjusted wage growth on the cards in 2026 and 2027.

Public sector workers, on the other hand, have been handed bumper rises all summer: junior doctors, 22pc; train drivers, 15pc; Armed Forces personnel, 6pc. The list goes on.

All of this has a measurable effect on the Government’s wage burden. The OBR forecasts the bill to go up by an average of 4.6pc between this year and 2029/30 – increasing by 30.7pc in total from £172bn to £225bn.

This is also because of a boom in the number of people on the state payroll. From 5.6 million in the first quarter of 2023, it will grow to 6.2 million by the same period in 2029 – up 10.6pc. The March forecast under the Conservatives came in 420,000 lower by that time.

Piecing together Budget and manifesto commitments, this surplus is likely to include 13,000 neighbourhood police officers, 8,500 additional mental health staff in the NHS, 6,500 teachers, 5,000 HMRC compliance officers and 3,000 extra workers tackling benefits fraud.

The implications on pensions are massive. By 2029, expenditure on public service pensions is set to be £2.4bn higher than under the Tories’ plans.

But the gap is only set to widen down the line. Annual growth was projected to average 3pc between 2023-24 and 2028-29 under former chancellor Jeremy Hunt – a figure that has now crept up to 3.6pc.

Given that government departments, however, also owe National Insurance contributions on their employees’ salaries, the net effect appears to be cancelled out.

But the cost remains, coming instead in the form of compensation paid out to the public sector through higher day-to-day

05 November 2024 6:00am GMT

The dark secret at the heart of Rachel Reeves’ Budget is buried at the bottom of page 41 of the 205-page Office for Budget Responsibility’s (OBR) assessment.

Labour’s policies, the fiscal watchdog deduces, are “shifting real resources out of private households’ incomes in order to devote more resources to public service provision”.

Tax and spend is back in a big way.

HM Revenue and Customs (HMRC) receipts are set to rise by some £40bn, the steepest hike since 1993, and over £70bn in additional expenditure will swell the size of the state to over 44pc of GDP – its most bloated since the early 2010s.

Forecasts show ordinary Britons are net losers in this equation, with real household disposable income £276 lower in five years’ time as a result of the Budget.

The Chancellor’s changes to employers’ National Insurance (NI) contributions – particularly the bump in the main rate from 13.8pc to 15pc – will make bosses’ tax bills £26,000 dearer on average. The majority of this will be passed on to employees in the long-term.

She has since admitted private sector workers will see a reduction in pay, with negative inflation-adjusted wage growth on the cards in 2026 and 2027.

Public sector workers, on the other hand, have been handed bumper rises all summer: junior doctors, 22pc; train drivers, 15pc; Armed Forces personnel, 6pc. The list goes on.

All of this has a measurable effect on the Government’s wage burden. The OBR forecasts the bill to go up by an average of 4.6pc between this year and 2029/30 – increasing by 30.7pc in total from £172bn to £225bn.

This is also because of a boom in the number of people on the state payroll. From 5.6 million in the first quarter of 2023, it will grow to 6.2 million by the same period in 2029 – up 10.6pc. The March forecast under the Conservatives came in 420,000 lower by that time.

Piecing together Budget and manifesto commitments, this surplus is likely to include 13,000 neighbourhood police officers, 8,500 additional mental health staff in the NHS, 6,500 teachers, 5,000 HMRC compliance officers and 3,000 extra workers tackling benefits fraud.

The implications on pensions are massive. By 2029, expenditure on public service pensions is set to be £2.4bn higher than under the Tories’ plans.

But the gap is only set to widen down the line. Annual growth was projected to average 3pc between 2023-24 and 2028-29 under former chancellor Jeremy Hunt – a figure that has now crept up to 3.6pc.

Given that government departments, however, also owe National Insurance contributions on their employees’ salaries, the net effect appears to be cancelled out.

But the cost remains, coming instead in the form of compensation paid out to the public sector through higher day-to-day

05 November 2024 6:00am GMT

The dark secret at the heart of Rachel Reeves’ Budget is buried at the bottom of page 41 of the 205-page Office for Budget Responsibility’s (OBR) assessment.

Labour’s policies, the fiscal watchdog deduces, are “shifting real resources out of private households’ incomes in order to devote more resources to public service provision”.

Tax and spend is back in a big way.

HM Revenue and Customs (HMRC) receipts are set to rise by some £40bn, the steepest hike since 1993, and over £70bn in additional expenditure will swell the size of the state to over 44pc of GDP – its most bloated since the early 2010s.

Forecasts show ordinary Britons are net losers in this equation, with real household disposable income £276 lower in five years’ time as a result of the Budget.

The Chancellor’s changes to employers’ National Insurance (NI) contributions – particularly the bump in the main rate from 13.8pc to 15pc – will make bosses’ tax bills £26,000 dearer on average. The majority of this will be passed on to employees in the long-term.

She has since admitted private sector workers will see a reduction in pay, with negative inflation-adjusted wage growth on the cards in 2026 and 2027.

Public sector workers, on the other hand, have been handed bumper rises all summer: junior doctors, 22pc; train drivers, 15pc; Armed Forces personnel, 6pc. The list goes on.

All of this has a measurable effect on the Government’s wage burden. The OBR forecasts the bill to go up by an average of 4.6pc between this year and 2029/30 – increasing by 30.7pc in total from £172bn to £225bn.

This is also because of a boom in the number of people on the state payroll. From 5.6 million in the first quarter of 2023, it will grow to 6.2 million by the same period in 2029 – up 10.6pc. The March forecast under the Conservatives came in 420,000 lower by that time.

Piecing together Budget and manifesto commitments, this surplus is likely to include 13,000 neighbourhood police officers, 8,500 additional mental health staff in the NHS, 6,500 teachers, 5,000 HMRC compliance officers and 3,000 extra workers tackling benefits fraud.

The implications on pensions are massive. By 2029, expenditure on public service pensions is set to be £2.4bn higher than under the Tories’ plans.

But the gap is only set to widen down the line. Annual growth was projected to average 3pc between 2023-24 and 2028-29 under former chancellor Jeremy Hunt – a figure that has now crept up to 3.6pc.

Given that government departments, however, also owe National Insurance contributions on their employees’ salaries, the net effect appears to be cancelled out.

But the cost remains, coming instead in the form of compensation paid out to the public sector through higher day-to-day